Sports betting sponsorship spend in Brazilian league football has grown exponentially between 2020 to 2024, in consequence of the relaxed stance on licensing regarding betting brands in the country.

A significant part of the exponential growth has stemmed from the influx of new brands in the market coming from international territories (6 out of 12 between the end of 2022 to 2024).

In this piece, we investigate the impact international betting brands are having on the sponsorship landscape, and what this means for Brazilian football.

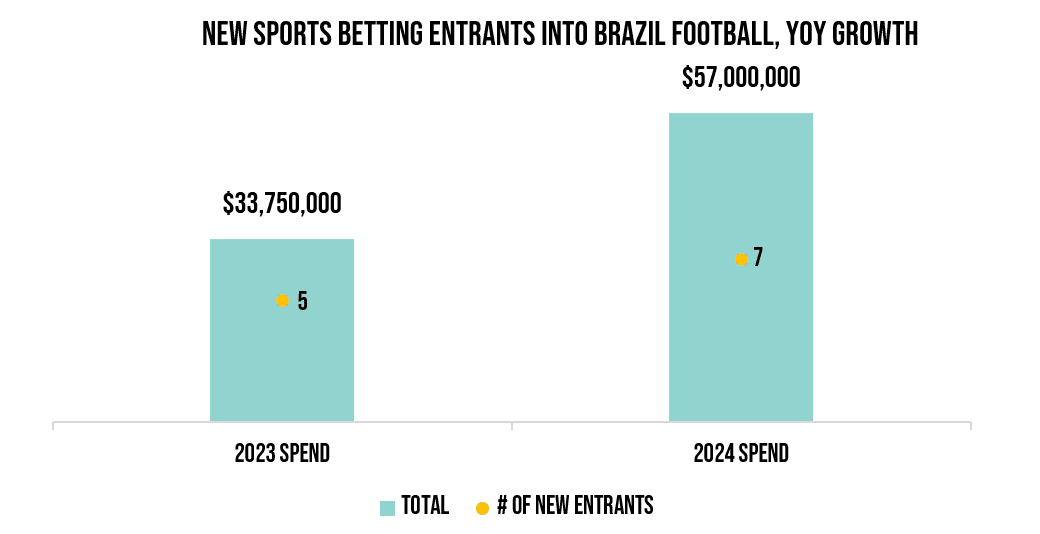

There have been twelve new sports betting brands enter Brazil’s top two divisions in the past two seasons. Six of these new entrants are from international territories (Superbet, Parimatch, Novibet, Stake.com, Betsat & BC.Game), spend a total of $41m as of the 2024 season which is 72% of new entrant spend this season.

International Sports Betting Investment Is On The Rise

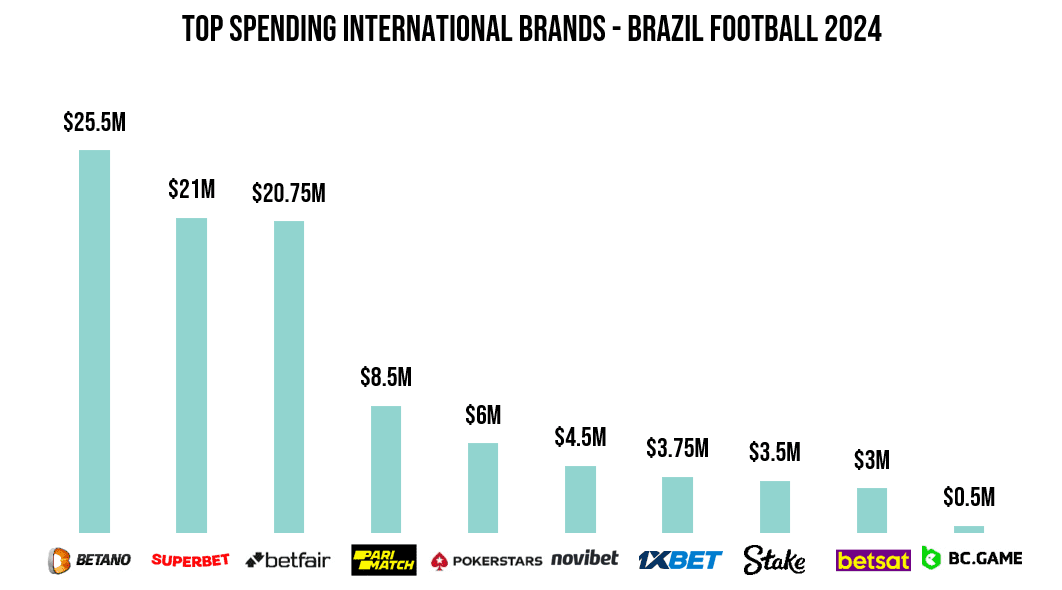

The current sports betting total spend in Brazil football is $210m from more than 60 active deals and with 27 brands. Of this $210m total spend, $97m (46%) is from international brands, looking to capitalise on the opening of the market and its high growth potential.

Moreover, nine of the ten international investors have entered the market since the 2021 season, the exception being Pokerstars and their long-term association with Neymar Jr. The average spend per annum of an international brand currently stands at $9.7m versus the $7m average of local Brazil brands.

Front Of Shirt Partnerships Are King For Sports Betting Brands

Front of shirt partnerships are the dominant strategy for new international brands entering the Brazil market, with nine partnerships from seven brands (only Pokerstars, 1xbet and BC.Game are not using this strategy currently).

The average investment on front of shirt assets by international investors is $2m more than their domestic peers, highlighting the increased competition in the market and the clamour for that all important share of voice. Superbet and Betfair have two front of shirts each and make up 65% of the overall front of shirt spend by international brands.

Other strategies such as naming rights are dominated by Betano, after they acquired the rights for Brazil’s top division, Serie A (they previously acquired Serie B and Copa do Brasil rights in 2023).

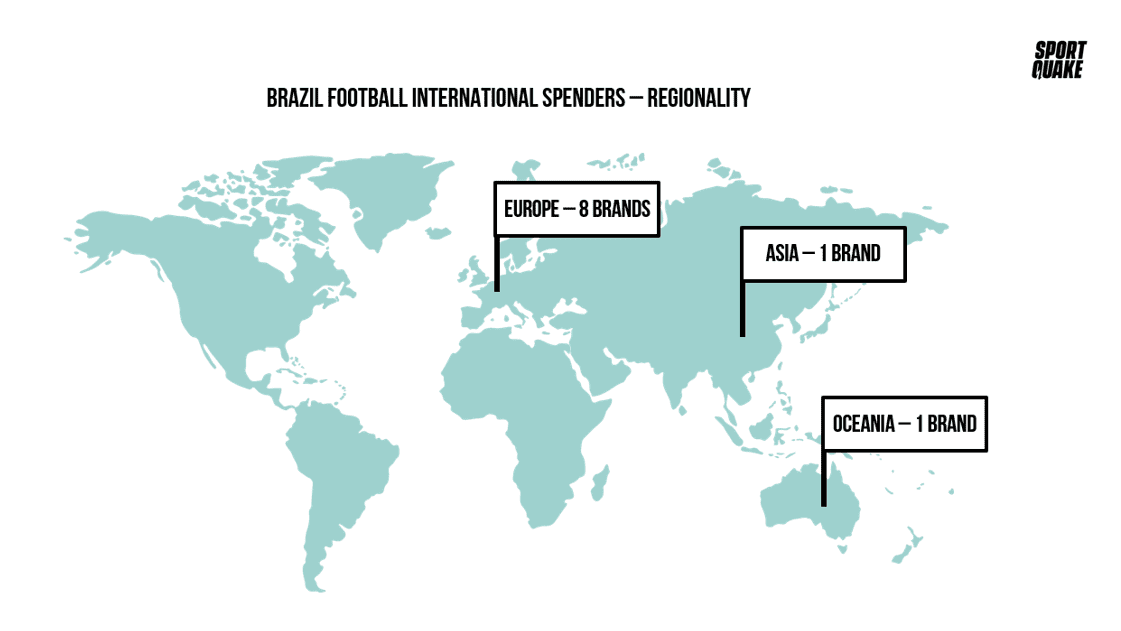

European Brands Are Making A Splash In Brazilian Football

Europe is leading the way in the international investment race with eight of the current international spenders coming from the region (80%).

Betano, the top ranked European spender, have bought into a multi-inventory strategy that includes the most premium naming rights partnerships in Brazilian football, plus a Serie A team front of shirt and LED media buy.

Romania-based Superbet, became the biggest international first-time spender to date in 2024 going from $0m to an estimated $21m, after they obtained Sao Paulo and Copa Libertadores winners, Fluminense front of shirts respectively.

Early projections for 2025 suggest an increase in investment from the sports betting category with a further influx in international investment from Asia and new regions such as North America.

If you’re looking to learn more about Brazil football sponsorship opportunities in your brand sector? Get in touch with the SportQuake team.

We work across all Brazil properties; all inventory and have deep understanding around sponsorship effectiveness and pricing. We help brands of all sizes navigate this complex sponsorship ecosystem to create the ultimate Premier League strategy to achieve their goals.

Recently, SportQuake helped Stake.com plan and buy their first front of shirt partnership in Brazil with EC Juventude. To find out more about this partnership, check out the article.