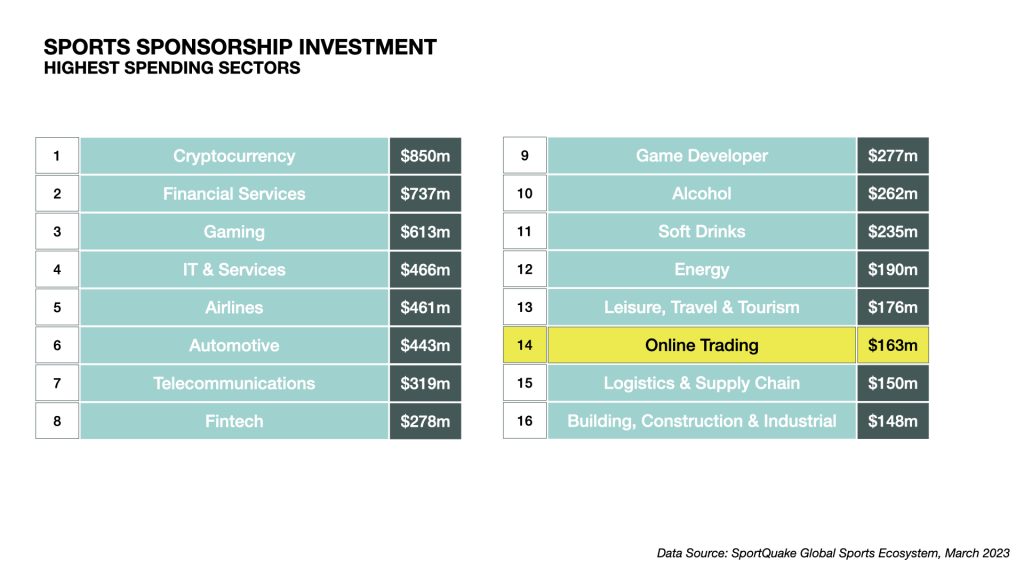

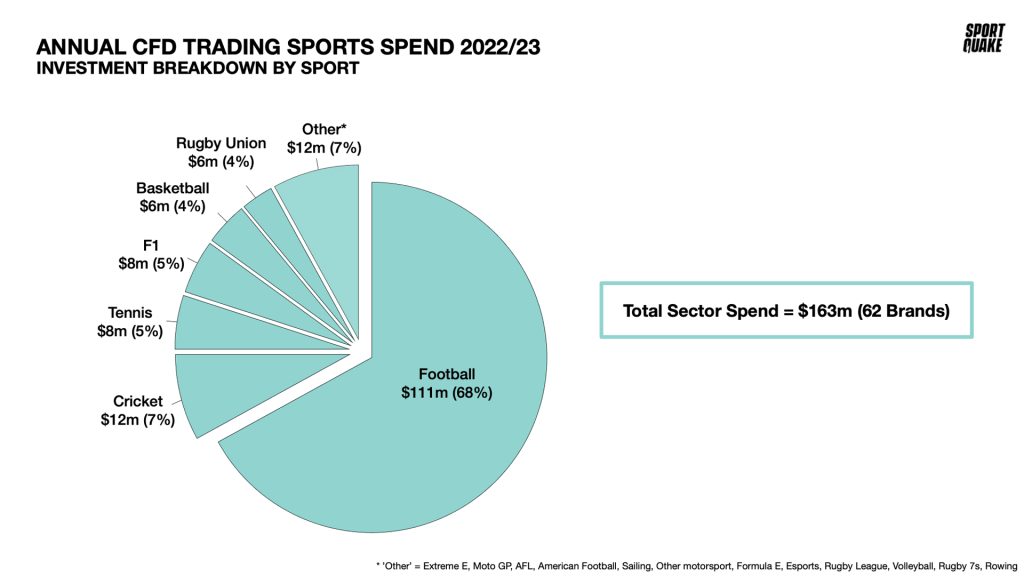

Sports sponsorship has become a key part of the marketing tool kit for online trading brands to drive key goals relating to brand awareness, trust & credibility and user acquisition. In 2022/23 a record 62 brands invested a record $163m into a wide range of sponsorship strategies and inventory, making online trading the 14th biggest brand sector spending in sports worldwide.

In this article, SportQuake CEO Matt House highlights the three key reasons why 2023 is the ideal time for brands to invest in sports sponsorship. For more information, get in touch with the SportQuake team at [email protected].

1) Sports Sponsorship: The #1 Growth Tool For Online Trading Brands

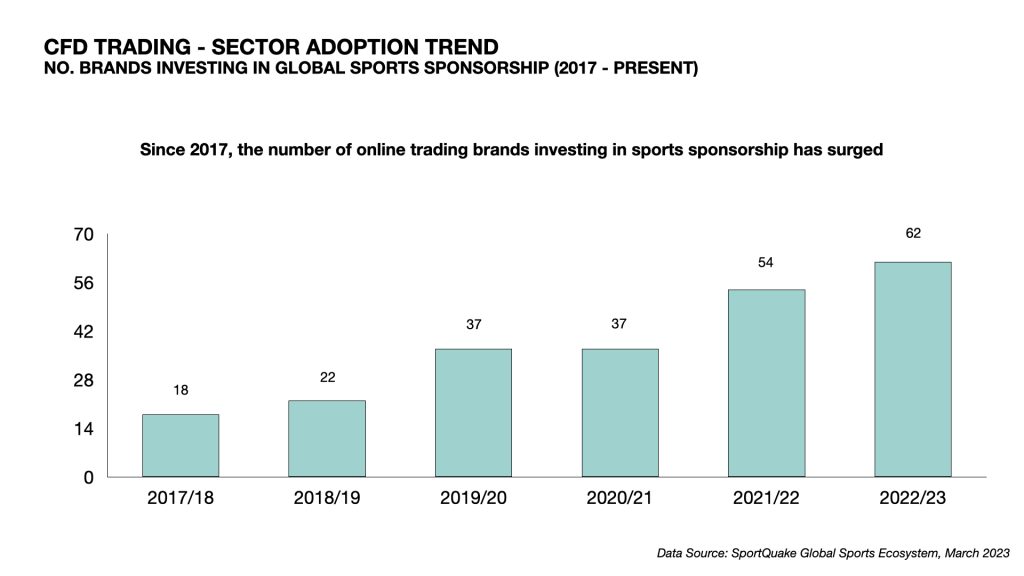

It’s 13 years since FX Pro became the first online trading brand to use sports sponsorship to drive growth, catapulting themselves onto the world stage with the Premier League shirt sponsorships of Fulham and Aston Villa back in 2010. Industry adoption remained low however, until Plus500 followed five years later with a long-term shirt sponsorship of Atletico Madrid. It wasn’t until eToro sponsored the Premier League and Bundesliga in 2018 that industry wide adoption of sports sponsorship by online trading brands really took off.

Now, a record 62 brands are investing an all-time high of $163m into a wide range of sports sponsorship strategies and inventory across 2022/23.

Football remains the dominant spend, reflective of aligning global marketing briefs with the most popular sport in the world, but other sports are increasingly being used in a material way to help brands with different challenges. For example, when Indian operator Upstox was looking to drive growth, it was natural to go to cricket (India’s #1 sport). Similarly, when Plus 500 was looking to increase coverage in the USA this year, it was natural to turn to the NBA (Chicago Bulls).

These 10+ years of spend have delivered multiple robust proof points around sports sponsorship driving both brand and customer growth across established and emerging brands, at both a global and local level, and has firmly established sports sponsorship as a key part of the online trading marketing toolkit for today. Looking forward, the future looks even more exciting as online trading and sports industries are well positioned for increased growth over the next decade.

2) More Touch Points, Bigger Audiences: Sport’s Digital Evolution Continues To Reach New Demographics

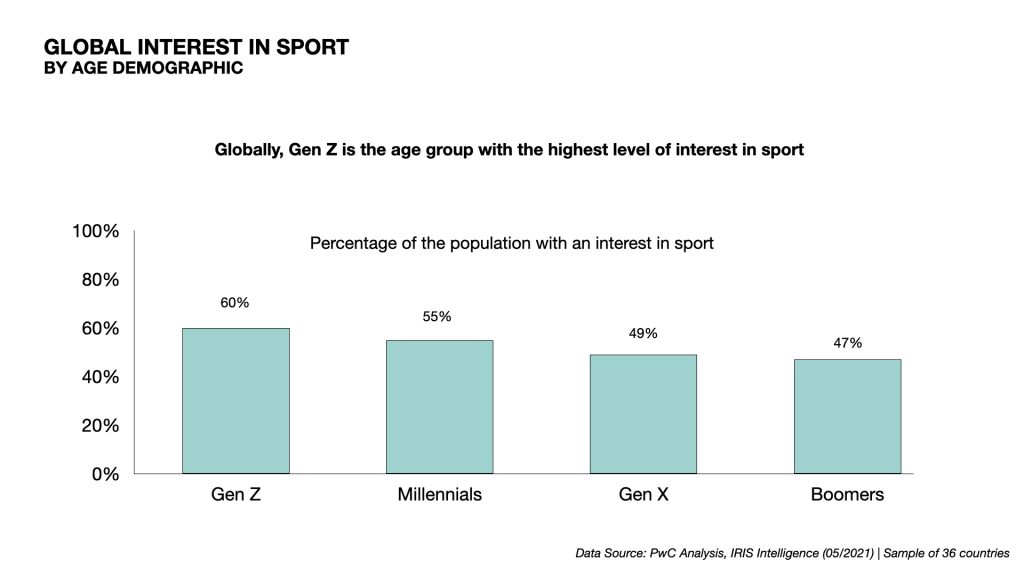

Over the past 20 years, sports sponsorship has become an established global brand building platform, dominating traditional media schedules. There has been speculation that changing demographics (led by the tech savvy Gen Z) and consumption habits (flight to social media etc) may impact the popularity of sports. However, a developing trend is that while people may be changing how they consume sports generally, it is still just as popular as ever – particularly among these new, emerging demographics.

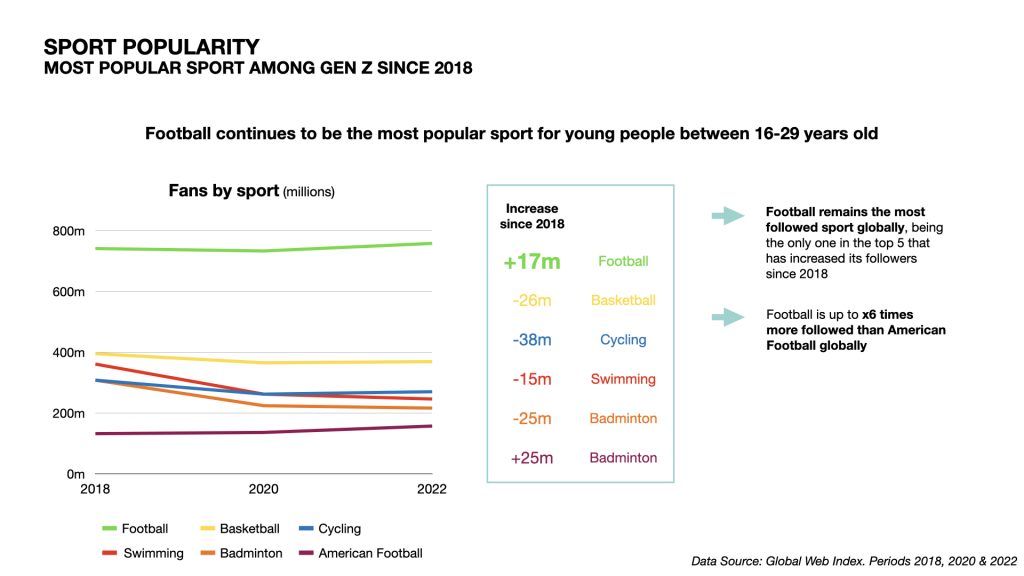

Within this, football remains the most popular sport.

The initial results from traditional sports collaborations with new content platforms is very encouraging, including the current trend of sport’s biggest rightsholders producing original long-form content series, such as “Drive To Survive” (F1 / Netflix), “All or Nothing” (NFL, Premier League / Amazon) and so on. These formats have shown to be extremely popular, consumed by a wide global audience, including non-conventional sports audiences, engaging a new generation of fans as a result.

Take Netflix’s hugely successful ‘Drive To Survive’. In the US, the series caused F1 viewership to double from 2020-2022, driven by considerable take up by the 16-25 demographic.

As a digital-first industry, this digital and social growth trend is extremely attractive to online trading brands, adding extra value into sport’s established 24/7/365 ‘always on’ multi-media marketing mix, driving higher levels of user engagement and converting more users deep into the sales funnel.

This is just the start. Over the coming years, streaming platforms and leading sports rights holders will move closer and closer together to drive engagement with core, lapsed and new audiences.

Bigger picture, with sport generally (and football specifically) having proven itself as a key driver of Pay TV and web 2.0, it’s inevitable that it will be at the heart of driving mainstream penetration of web 3.0/ the metaverse as this comes together over the next decade.

3) The ‘Crypto Winter’ Creates a HUGE Buying Opportunity For Online Trading Brands

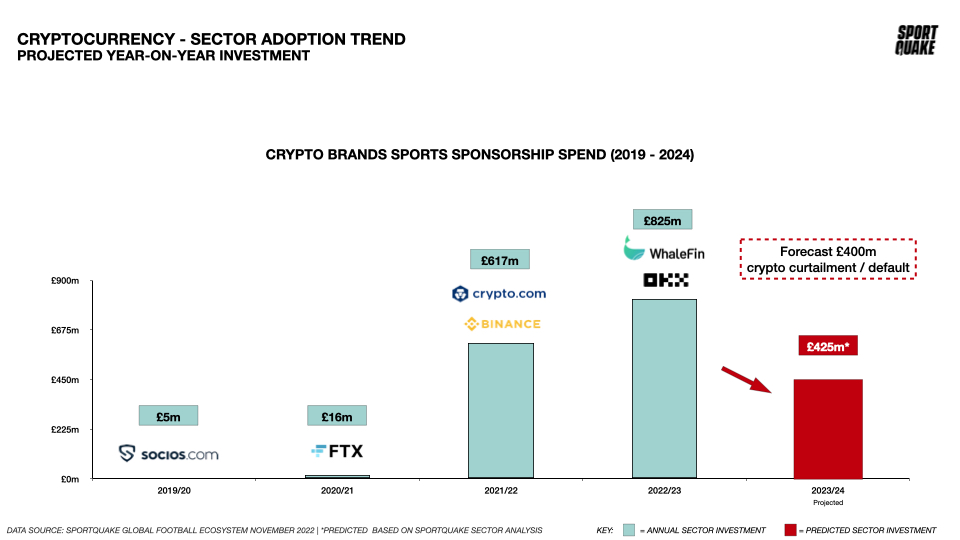

The well-publicised ‘crypto winter’ hit in the second half of 2022, having a detrimental impact on all corners of the industry, including investment in sports sponsorship.

While the 18 months leading up to the crash had seen crypto sector investment boom to $800m+, the upcoming 2023/24 year will see a considerable decrease with key crypto spenders going bust or looking to restructure marketing commitments.

High profile defaults include FTX (Miami Heat arena / Mercedes F1 sponsor) and Whalefin (Chelsea sleeve sponsor / Atletico Madrid Front of Shirt sponsor).

Crypto’s loss is a gain for online trading brands.

With online trading brands now firmly established as a long-term investor across global sports, teams and athletes are looking increasingly favourably towards the online trading sector as a dependable, credible partner.

Due to the ‘crypto winter’ – and the various defaults and restructurings caused by it – there is a good opportunity for online trading brands to buy quality sports sponsorship assets at pre-crypto boom pricing ahead of the 2023/24 season.

Are you interested in finding out more about sports sponsorship and how it could help to elevate your brand marketing efforts? Get in touch with the SportQuake team to find out more.

SportQuake is a global sports sponsorship agency. We connect brands with the global sports phenomenon, specifically helping new economy brands, including online trading and online sports betting, to plan and buy high-profile global sports sponsorship strategies that drive growth.

This article originally appeared in Finance Magnates.