Brazilian football is on the rise and is well placed to become the next global frontier within the sports industry. The league is set to reform and become more focused on revenue generation, after a football law passed in 2021 encouraged clubs to be run more like businesses. This has had the effect of attracting huge interest from prospective investors, with some US-led investment already in place at Botafogo and Vasco da Gama. The aim –

create a more modernised football product that can reach much wider overseas audiences.

The combined revenues of the clubs remain well below those in the top European leagues, but they are growing fast. Contributing to this fast-paced growth are some specific sponsorship categories, including the sports betting sector which we investigate in more detail below.

Brazil Football Sponsorship – The Sports Betting Landscape

Sports betting sponsorship spend has grown exponentially between 2020 to 2024 and is one of the main drivers of the league’s revenue boost. The relaxed stance on licensing regarding betting brands in Brazil has created unique market conditions with many different players vying for awareness and matchday exposure in the country’s most watched sport.

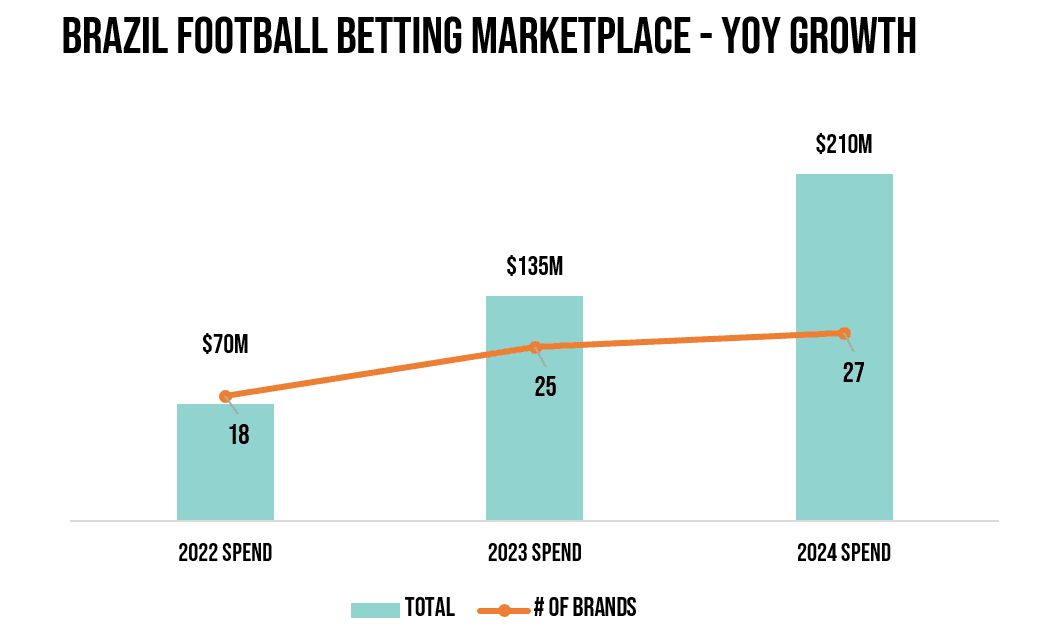

From 2020 to 2024, the sports betting market value has leaped from $3.8bn to $13.3bn – a 250% growth. This has impacted football sponsorship activity with there now showing more than 60 active deals, from 27 brands spending $210m per annum.

The buyers are made up of strong local brands and an influx of foreign investors such as Betano, Superbet and Betfair. The new entrants have increased total spend significantly year-on-year, up $75m on 2023 (56% increase).

As the number of investors begins to plateau, average spend per brand continues to soar which currently sits at $8m per annum, largely due to increased investment in front of shirt inventory.

What Strategies are Sports Betting Brands Using?

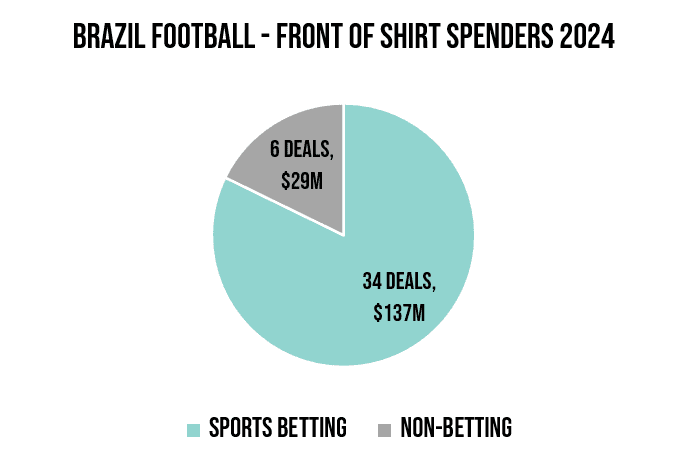

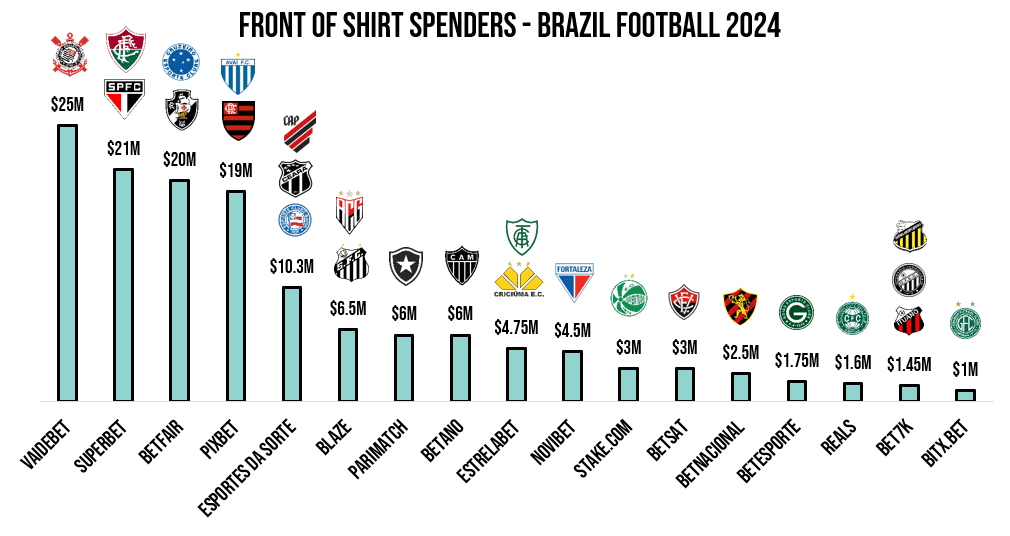

The most popular sponsorship strategy for sports betting brands in Brazil is Front of Shirt partnerships. For the 2024 season 34 out of the 40 clubs (85%) across Brazil Serie A & Serie B have front of shirt partners from the category, spending $137m (65% of the total sports betting spend in Brazil).

The recent boom in investment from sports betting brands can be attributed to the bull market created by relaxed regulations on licensing and high appetite for market share from new entrants.

Six brands in 2024 (vs one brand in 2023) are now spending $20m+ on sponsorships in Brazilian football. Three of these (Vaidebet*, Superbet & Betfair) are spending these fees on front of shirt partnerships alone, highlighting the strength of the market for this particular asset.

*Vaidebet & Corinthians partnership was cancelled on 7th June 2024 after an investigation into third-party corruption

If you’re looking to learn more about Brazil football sponsorship opportunities in your brand sector? Get in touch with the SportQuake team.

We work across all Brazil properties; all inventory and have deep understanding around sponsorship effectiveness and pricing. We help brands of all sizes navigate this complex sponsorship ecosystem to create the ultimate Premier League strategy to achieve their goals.

Recently, SportQuake helped Stake.com plan and buy their first front of shirt partnership in Brazil with EC Juventude. To find out more about this partnership, check out the article.